ARCTIC PAPER GROUP THROUGH 3 QUARTERS OF 2013

FINANCIAL RESULTS – DETAILS

Selected quarterly financial results of the Arctic Paper Group are presented in the table below:

| PLN ’000 | 3Q 2013 | 3Q 2012 | Change (A/B) |

| Sales revenue | 784,000 | 680,723 | +15.2% |

| Operating profit (loss) | (7,046) | 10,501 | n/a |

| EBITDA | 23,549 | 41,845 | -43.7% |

| Net profit (loss) | (15,291) | (1,483) | n/a |

Selected financial results of the Arctic Paper Group through the first three quarters of 2013, not reflecting the impairment of non-financial assets of AP Grycksbo, are presented in the table below:

| PLN ’000 | 1–3Q 2013* | 1–3Q 2012 | Change |

| Sales revenue | 2,370,007 | 2,009,584 | +17.9% |

| Operating profit (loss) | (35,232) | 41,562 | n/a |

| EBITDA | 59,263 | 133,618 | -55.6% |

| Net profit (loss) | (59,236) | 16,168 | n/a |

* On 30 June 2013, the company made a write-down for impairment of non-financial assets of AP Grycksbo in the amount of PLN 66.6m, which had an impact on EBIT in the amount of –PLN 66.6m, and on the net result of –PLN 54m. The write-downs are of an accounting nature and do not affect the current operations of the group.

Selected financial results of the Arctic Paper Group through the first three quarters of 2013 are presented in the table below:

| PLN ’000 | 1–3Q 2013* | 1–3Q 2012 | Change | |

| Sales revenue | 2,370,007 | 2,009,584 | +17.9% | |

| Operating profit (loss) | (101,881) | 41,562 | n/a | |

| EBITDA | 59,263 | 133,618 | -55.6% | |

| Net profit (loss) | (113,223) | 16,168 | n/a |

* Results reflecting the write-down for impairment of non-financial assets of AP Grycksbo

In the first three quarters of 2013, the group generated revenue 17.9% higher than in the same period of the prior year. Due to acquisition of the Rottneros Group in December 2012, the revenue and costs of Rottneros are included in the consolidated profit and loss account of the Arctic Paper Group from 1 January 2013. Revenue from sales of products of the Arctic Paper Group without including revenue of the Rottneros Group was PLN 1.886mld in the first three quarters of 2013, 6.1% less than the revenue in the same period of 2012. This decline was due to both a reduction in the quantity of paper sold as well as a decline in the unit price as expressed in PLN.

It should be stressed that Arctic Paper lost 4.2% in the volume of its paper sales during the first three quarters of 2013, compared to a decline in the market of 6.8%, although it did not avoid an impact of the difficult market situation on the prices of the products offered by the group.

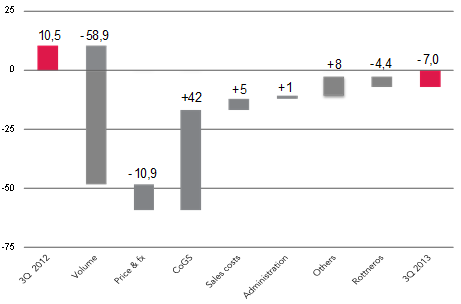

The operating result in the 3rd quarter of 2013 was –PLN 7.0m, compared to PLN 10.5m in the same quarter of 2012. The main reason for this decline was the lower paper sales volume (–PLN 58.9m), changes in prices, and the negative effect of exchange-rate differences (–PLN 10.9m). This was partially offset by the positive contribution of own cost of sales of +42,5m (chiefly due to lower volume). Costs of sales, general administration and others exerted a positive influence of +PLN 14.2m. The contribution of Rottneros to the operating result during the period was negative, at –PLN 4.4m.

Evolution of EBIT

In 3Q 2013, the Arctic Paper Group achieved significant growth in EBITDA compared to 2Q 2013, mainly in connection with greater sales volume than in 2Q 2013 and a higher average sale price. Compared to 3Q 2012, EBITDA was PLN 18.3m lower, chiefly as a result of the lower paper sales volume year-on-year (-8,79%).

SALES IN 3Q 2013

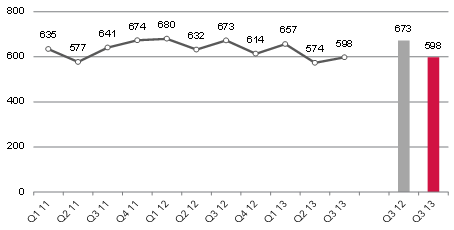

Paper sales revenue of the Arctic Paper Group in 3Q 2013, generated by the group’s paper mills (without reflecting Rottneros), was PLN 598m, representing an increase of 4.3% from 2Q 2013 and a decline of 11.1% from 3Q 2012. Cumulative revenue through the first three quarters of 2013 was PLN 1.8mln, down 7.9% year-on-year.

Sales revenue (PLNm) without reflecting Rottneros

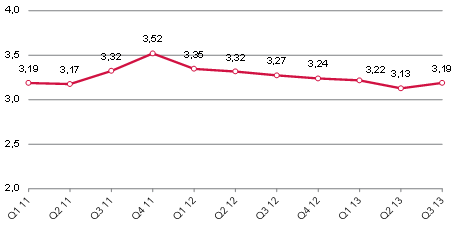

Revenue per tonne of paper sold, expressed in PLN, was PLN 3,190 in 3Q 2013, an increase of 2.0% from 2Q 2013 and a decline of 2.67% from 3Q 2012. Through the first three quarters of 2013, revenue per tonne of paper sold was PLN 3,180, down 4.0% from the first three quarters of 2012.

Revenue per tonne of paper sold (PLN ’000)

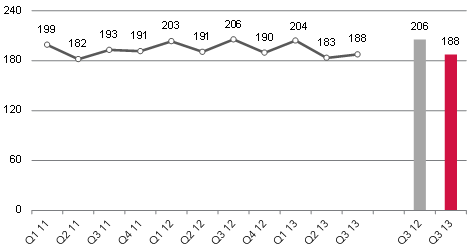

In 3Q 2013, the Arctic Paper Group recorded a decline in sales volume compared to 3Q 2012 of 8.87% and a cumulative decline of 4.2% year-on-year. Sales volume in 3Q 2013 was 188,000 tonnes, and in the first 9 months of 2013 was 575,000 tonnes.

Sales volume (’000 tonnes)

Wolfgang Lübbert, CEO of Arctic Paper S.A., commented: “We regard the third quarter of this year as a period of improvement in our situation. Despite further declines on the European graphic paper market, the decline in sales at Arctic Paper was lower than the decline of the overall market. This means that we are continuing to increase our market share. In late summer of this year we implemented a profit improvement plan, and we can already observe its first positive effects. We expect significant improvement in this respect in 2014. We anticipate that the market environment will remain difficult in the upcoming period. Nonetheless, favourable changes may be expected during the next few months, as well as an improvement in the profitability of Arctic Paper compared to the first half of this year.”

The CEO added: “Keeping up with market changes, we are working intensively on development of new products in order to stimulate sales despite the weakness in demand on the market. In the next six months we intend to introduce new products at three of our paper mills. We already introduced a new product line for the packaging market at the Arctic Paper Grycksbo plant, in October. Arctic Paper Kostrzyn, Arctic Paper Munkedals and Arctic Paper Mochenwangen will offer new products from the early 2014.”

More information for the media provided by:

Iwona Mojsiuszko, M+G

tel. +48 22 416 01 02, +48 501 183 386

e-mail: iwona.mojsiuszko@mplusg.com.pl

ARCTIC PAPER S.A is the second-largest European producer of bulky book paper in terms of production volume, and one of the leading producers of high-quality graphic paper. The Group produces uncoated and coated wood-free paper and uncoated wood-containing paper for printers, book publishers, magazine publishers, the advertising sector and paper distributors. The Group’s product line includes well-known brands such as Amber, Arctic, G-Print, Munken, Pamo, L-Print and AP-Tec.

The Group has four paper mills: at Kostrzyn in Poland, at Munkedal and Grycksbo in Sweden and at Mochenwangen in Germany. The total production capacity of the four paper mills in the Group is over 800,000 tonnes per year.

- Arctic Paper Kostrzyn has production capacity of around 275,000 tonnes annually and produces mainly uncoated, wood-free paper for general printing uses, such as books, brochures, forms and envelopes.

- Arctic Paper Munkedals has production capacity of around 160,000 tonnes per year and produces mainly high-quality, uncoated, wood-free paper, used primarily for books and advertising brochures.

- Arctic Paper Mochenwangen has production capacity of around 115,000 tonnes per year and produces mainly uncoated, wood-containing paper, used primarily for books and flyers.

- Arctic Paper Grycksbo has production capacity of around 265,000 tonnes per year and produces high-quality, coated paper, used for maps, books, magazines, posters and direct mail materials.

The Group also owns two pulp plants, with a combined production capacity of 410,000 tonnes per year.

- The pulp plant in Vallvik, Sweden, has a production capacity of about 240,000 tonnes per year and produces two types of long-fibre sulphate pulp: fully bleached sulphate pulp and unbleached sulphate pulp.

- The pulp plant in Rottneros, Sweden, has a production capacity of about 170,000 tonnes per year and produces mainly two types of mechanical pulp: groundwood and CTMP.

The distribution companies and sales offices handling the distribution of paper and marketing of the Group’s products are an important part of the Group. At present, the Group has 15 distribution companies and sales offices in Europe, providing access to all European markets and securing 20% of the European market for bulky book paper.

The Arctic Paper Group employs around 1,800 people. The headquarters of the international Group are in Poland. The largest shareholders of Arctic Paper S.A. are the Swedish companies Trebruk AB (formerly Arctic Paper AB) and Nemus Holding AB, which, after including the results of the final period of the tender offer for the shares of Rottneros AB, hold a combined 68.3% of the shares. The Arctic Paper Group has been listed on the Warsaw Stock Exchange since October 2009 and since December 2012 on NASDAQ OMX in Stockholm.

Further information is available at www.arcticpaper.com